A cash-starved global economy and determined political manoeuvring helped start uncover tax havens this year, but so far it is the US that has managed a peek into secret Swiss accounts while India only got as far as round-table meetings to ask for its chance, reports PTI.

A cash-starved global economy and determined political manoeuvring helped start uncover tax havens this year, but so far it is the US that has managed a peek into secret Swiss accounts while India only got as far as round-table meetings to ask for its chance, reports PTI.

The US-Swiss deal giving the Internal Revenue Service access to 4,450 secret accounts came after bitter wrangling that even put their bilateral ties in jeopardy. The deal created cracks in

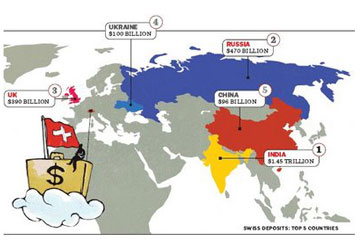

Tax havens are estimated to hold assets worth $11 trillion—more than twice the value of stimulus measures announced globally to combat the global financial crisis—and united leaders of G-20 countries in the quest to get this money out. In April this year, the leaders pledged to crack down on tax havens.

In

Way back in 1999, a book 'Black Economy in India' by Jawaharlal Nehru University (JNU) Professor Arun Kumar estimated the quantum of black money at Rs4,87,185 crore, which was 40% of gross domestic product (GDP) at that time.

With countries beginning to push their case for revealing of account details, the Organisation for Economic Cooperation and Development (OECD), which sets international tax norms, said the efforts against tax havens have seen tremendous progress.

A top OECD official said that so far this year, as many as 280 agreements have been signed between various countries bilaterally for exchange of information, especially those related to tax.

"This in itself shows the progress made by the OECD initiative. There has been tremendous progress (in cracking down on tax havens)," the OECD official told PTI from

The prominent among those countries which agreed for increased exchange of information with others are

"Last year, most of the offshore financial centres did not exchange tax information even though many had committed to do so. This year, we have seen the completion of hundreds of (bilateral) agreements," the official noted.

— Yogesh Sapkale